|

25-31 October 2000 |

|

Focus on negotiating Interests, value and the art of the best deal Managers should negotiate to create value, as well as claim it Vilhena Funds AGM "Assets under management in the Vilhena Funds SICAV plc. have increased by an impressive 42% from Lm36.19 million as at 30 June 1999 to Lm5l.58 million as at 30 June 2000. The number of shareholders has tipped the 3,500 mark." Chairman Dr Remigio Zammit Pace announced during Vilhena Funds’ Annual General Meeting. FEXCO Investment Services launched amid expanding industry FEXCO Investment Services (Malta) Limited was recently launched. The company has been licensed to conduct Investment Services business by the Malta Financial Services Centre. At a reception Finance Minister John Dalli welcomed this new initiative by FEXCO Investment Services (Malta) Limited. Feature E-government finding its place in the IT revolution: The clear advantages of embracing e-government Attaining e-government in Malta MITTS aims to create a virtual government Opinion The benefits of standardisation Prof. Josef Bonnici, Minister for Economic Services, recently addressed a seminar titled ‘The Benefits of Standardisation to Industry' in which the minister lays out the current role of the Malta Standardisation Authority and its anticipated evolution |

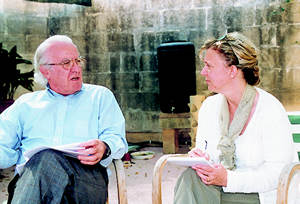

In the interests of the minority With economic trends abroad moving increasingly towards mergers, take-overs and privatisation, the need to protect companies' minority shareholders has become a growing issue. Today John Borg Bartolo, a former senior bank executive and currently a director on the board of HSBC Bank Malta plc, talks to Miriam Dunn about the newly-formed Malta Minority Shareholders' Association, which, as he explains, aims to protect the interests of the ‘small fry' How did the formation of the Malta Minority Shareholders’ association come about? The decision to form a minority shareholders’ association was made for various reasons. Firstly the time seemed ripe to move further ahead in safeguarding the interests of minority shareholders in companies that are listed on the Malta Stock Exchange by setting up a new association that would cater for minority investors in general. When the decision was made to liquidate the Association for the Minority Shareholders of Mid-Med Bank plc after achieving the objectives we had set out to achieve, it became evident that there was a huge vacuum in minority shareholder representation in our society. The timing also seemed particularly appropriate since the current policy of government on privatisation and the globalisation of economics, especially in the financial and investment markets, makes it even more imperative to converge separate initiatives in the interest of the small shareholders. With this in mind, action was taken to work on the premise of a general association whose main objective would be to protect the minority investors’ interests. You said that the Association for the Minority Shareholders of Mid-Med Bank achieved all its objectives. What were these? Our first achievement was to successfully defend the minority shareholders’ interest from the ‘forced’ bid of Lm2.90 per share of the majority shareholder, by taking court action. As we always stressed, we were never against the sale of Mid-Med Bank in principle, but we felt that the way the deal was done left much to be desired. I welcomed the sale, but at the end of the day, I thought that Government did not handle the matter in the appropriate manner. So much so, that I wrote a few articles on the matter. In fact, my first article on the issue was entitled, ‘Good move, bad deal’. This summed up how I felt about the issue; I agreed with the principle of a strategic partner, but you have to control the strategic partner in the sense that one would not let him behave as if he were the Almighty, even though he owns a controlling interest. Such a situation has to be controlled with the appropriate legislation. I clearly express my views, in my writings, that I would have never permitted the strategic partner a 70 per cent shareholding. My colleague, Alfred Mifsud, and I were particularly concerned by the fact that local investors were put in a somewhat precarious situation when the Malta Stock Exchange suspended, unduly, dealings in Mid-Med Bank shares. As I said already, the minority shareholders were subsequently subjected to a quasi-forced sale when HSBC was allowed to make a public bid for the shares at the price of Lm2.90 per share, in an attempt to acquire 100% holding in the local bank. The association enabled us to put up a united front to seek redress wherever it was felt necessary. Our court action meant that HSBC had to change tack and accept the minority shareholder as a partner. The association sought recourse before the Malta Stock Exchange tribunal to protest against the undue length of time (5 April 1999 to 2 June 1999) during which dealings in Mid-Med Bank shares were suspended. The said tribunal was not yet appointed at the time, and was appointed specifically due to our demands. As a result of our actions, the MSE took steps to protect the minority interests in the Bank. It granted them the right to abort a de-listing attempt by the majority shareholder if 5% or more of the minority shareholders object to such a de-listing. Initially, de-listing could only be aborted if more than 25% of the minority opposed. The success of our initiatives had no doubt helped to add value to the 30% holding in the hands of the minority group. Taking into account the share price at its highest – that is Lm7.50 (as compared with HSBC’s offer of Lm2.90) this added value amounted to over Lm50 million. The last activity of the association was to put all its weight in support of my candidature when, last March, I contested the election of the three directorships (representing the minority shareholders) on the board of HSBC Bank Malta. Why do you think there is a need for a minority shareholders association? The Mid-Med Bank story made it evident that there existed in our society a vacuum, insofar as the interests of the minority shareholders generally were concerned. Our belief was further strengthened by encouragement prompted by countless individuals from all walks of life. The case of the Bank of Valletta selling its holdings in Mid-Med bank to HSBC would not have remained uncontested had an appropriate shareholders’ association been in existence then. When, in May of last year, the government agreed to sell Mid-Med Bank to HSBC, it also ‘committed’ the Bank of Valletta to selling its shares in Mid-Med Bank to HSBC at the price of Lm2.90, notwithstanding the fact that government held a minority shareholding in BoV. The end result was a capital loss for BoV which, in turn, meant a loss for its shareholders. How are you expected to protect the interests of minority shareholders? In an endeavour to improve on our past successes, I established contact with Euroshareholders, a confederation of European Shareholders Associations, which was founded in 1990 and is based in Brussels. Euroshareholders currently has a membership of nine national shareholders’ associations, made up of Belgium, Denmark, France, Germany, Luxembourg, Netherlands, Spain, Sweden and the UK. The overall task of this European confederation is to seek the interests of individual shareholders in companies in the EU. The confederation’s main objectives are to support harmonisation at the EU level on issues such as minority shareholder protection, transparency of the capital markets and cross-border proxy voting, to enhance shareholders value in European companies and to support corporate governance at European level. In fact, all the above objectives tally with our own objectives. One may question the need to affiliate with the European confederation. One may also argue that in the Mid-Med case, we acted under our own steam and made a lot of headway, despite the fact that all odds were against us. This is all very true, and we shall continue to fight our own battles like all the other individual associations. But we should not limit ourselves to the national dimension and forget the world around us. The rapid globalisation that is going on around us must enlighten us to look beyond our shores.  In the Mid-Med instance we had a battle to fight which we fought

with success and reaped maximum benefits. However, the case made

us wiser and enlightened us to look further ahead, bearing in

mind the local aspect in the context of government’s privatisation

programme, and the globalisation of the markets. Not less important

is Malta’s application to join the EU. Alone we surely can

be a voice, but with eventual affiliation with our European colleagues

we shall definitely become a force.

In the Mid-Med instance we had a battle to fight which we fought

with success and reaped maximum benefits. However, the case made

us wiser and enlightened us to look further ahead, bearing in

mind the local aspect in the context of government’s privatisation

programme, and the globalisation of the markets. Not less important

is Malta’s application to join the EU. Alone we surely can

be a voice, but with eventual affiliation with our European colleagues

we shall definitely become a force.The new association should be seen by the private shareholders as the guarantee of their rights in present and future publicly listed companies. Eventual joining forces with the other European Shareholders Associations is confirmation of our belief that in unity there is strength. The secretary general of the confederation was recently in Malta. In fact, he attended the press conference which we held on 12 October, to launch the new association. We are now planning to have an official of Euroshareholders out here again soon to address the gathering in our first general meeting. Their support is undoubtedly invaluable. Can you elaborate on some of the Confederation’s guidelines? The European Confederation of Shareholders Associations believes, for example, that mergers and take-overs, distribution of profits and stock-option schemes, share buy-back programmes and capital increases connected with the exemption of pre-emptive rights of the existing shareholders should all be subject to shareholder approval. It also states that major decisions which have a fundamental effect upon the nature, size, structure and risk profile of the company, and decisions which have significant consequences for the position of the shareholder within the corporation, should be subject to shareholders’ approval or should be decided by the AGM. In its guidelines, the Confederation states that anti-take-over defences or other measures which restrict the influence of shareholders should be avoided, while also recommending that the process of mergers and take-overs should be regulated and compliance with these regulations should be supervised. The Confederation insists on the Right to Information. It considers Disclosure and Transparency and a basic principle to any corporate governance framework. It also clearly expresses it views on the Role and Structure of boards of directors. What legislative changes do you envisage the government will have to make to take account of changing trends in company structures, including mergers and take-overs, to help safeguard shareholders? Well that's a little bit of a tough question. I do not think I am competent to say what legislative changes will become necessary. It would be presumptuous of me to do that. Even the lawmakers would have to sit back and do some serious thinking about it. What I am sure of is the fact that changes cannot be avoided. If you just take the Mid-Med case for an example, the need for change had been felt on the day government announced its intention of disposing of its holding in the bank. Hence the founding of the first association of the minority shareholders. Had the Authorities given some though to certain issues, perhaps the birth of the association could have been averted. Another issue which had arisen as a consequence of the Mid-Med Case, was the fact that when I came to contest the election of directors in the HSBC Bank (formerly Mid-Med Bank) the list of shareholders, which by law is a public document and hence should be available, at a fee, to the general public from the Registrar of Companies within The Malta Financial Services Centre, was in fact unavailable. This put me at a great disadvantage with the other contestants for the post. Suffice it to say that I even filed an official protest at the law courts on this issue Finance Minister John Dalli shared my concern but did nothing about it to spare me the said disadvantage. He admitted that there exists a flaw in the legislation which ‘divested’ the MFSC from its obligations. He also told me, in fact he made a public announcement on one of the local TV stations, that he will take the necessary steps to amend the law to put matters right. This incident took place in March of this year. To date, as far as I am aware, the legislation has remained unchanged. Until then, potential contestants to directorships may encounter such problems. I recently called again on the office of the Registrar of Companies to obtain an up-to-date list of shareholders of one of the publicly listed companies and was again informed that it was not available. This is the unfortunate situation we have to bear in this country, we know of and admit the flaws in our systems and do little, if anything, about them. I can envisage that Government's privatisation strategy is bound to bring about the need of changes in the Companies Act. The said Act is already in need of updating and I hope that this will be taken in hand at an early date. Attention needs to be given to company structures particularly to the composition of Boards of Directors to ensure proper corporate governance amongst other things. Photos by Paul Blandford | ||||||||||

The Business Times, Network House, Vjal ir-Rihan San Gwann SGN 07 | Tel: (356) 382741-3, 382745-6 | Fax: (356) 385075

Editor: Saviour Balzan

e-mail: [email protected]